Note: This is a conceptual project created as part of a design challenge and is not affiliated with the U.S. government, IRS, or any official agency. All designs and branding are fictional and created independently.

Project Overview

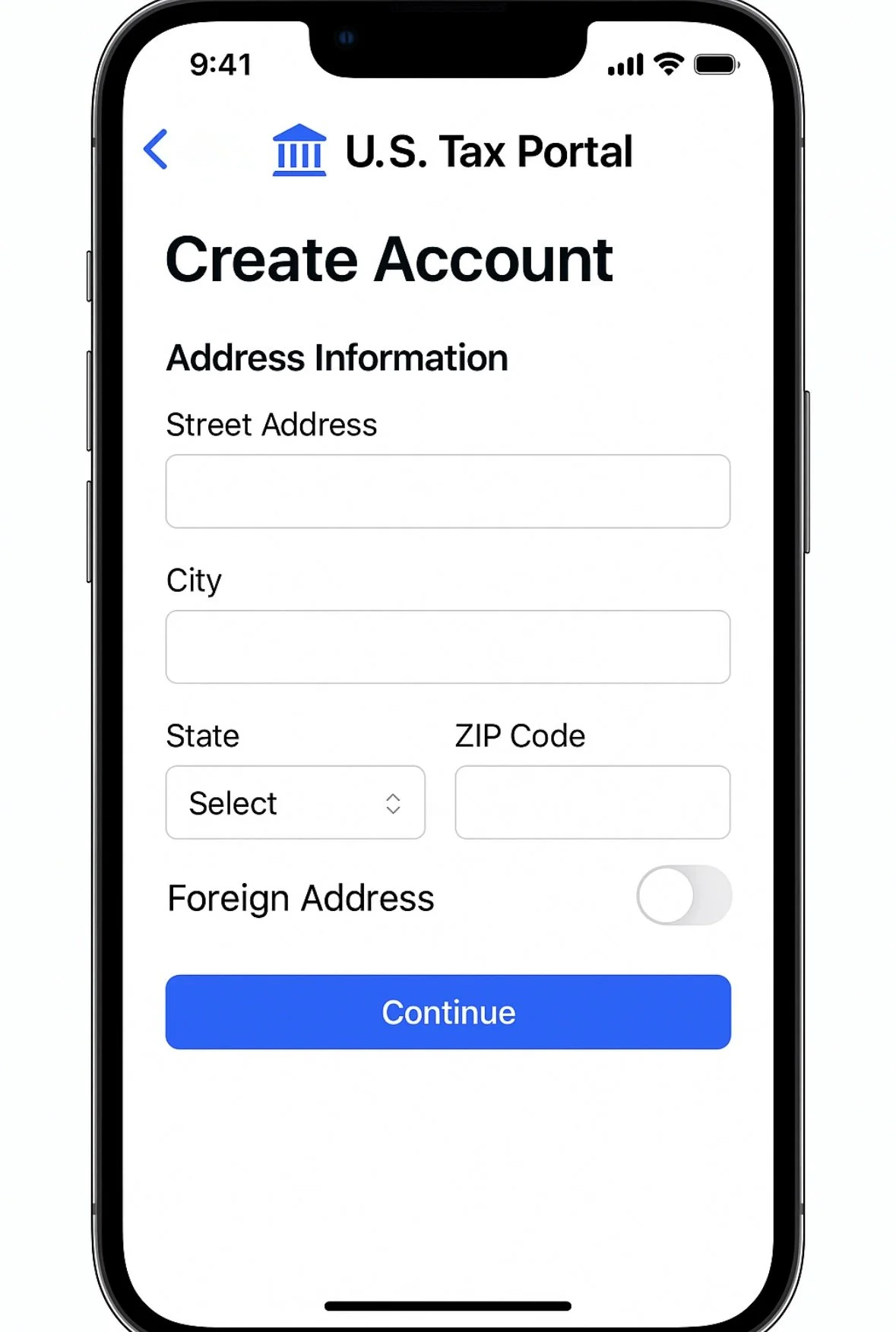

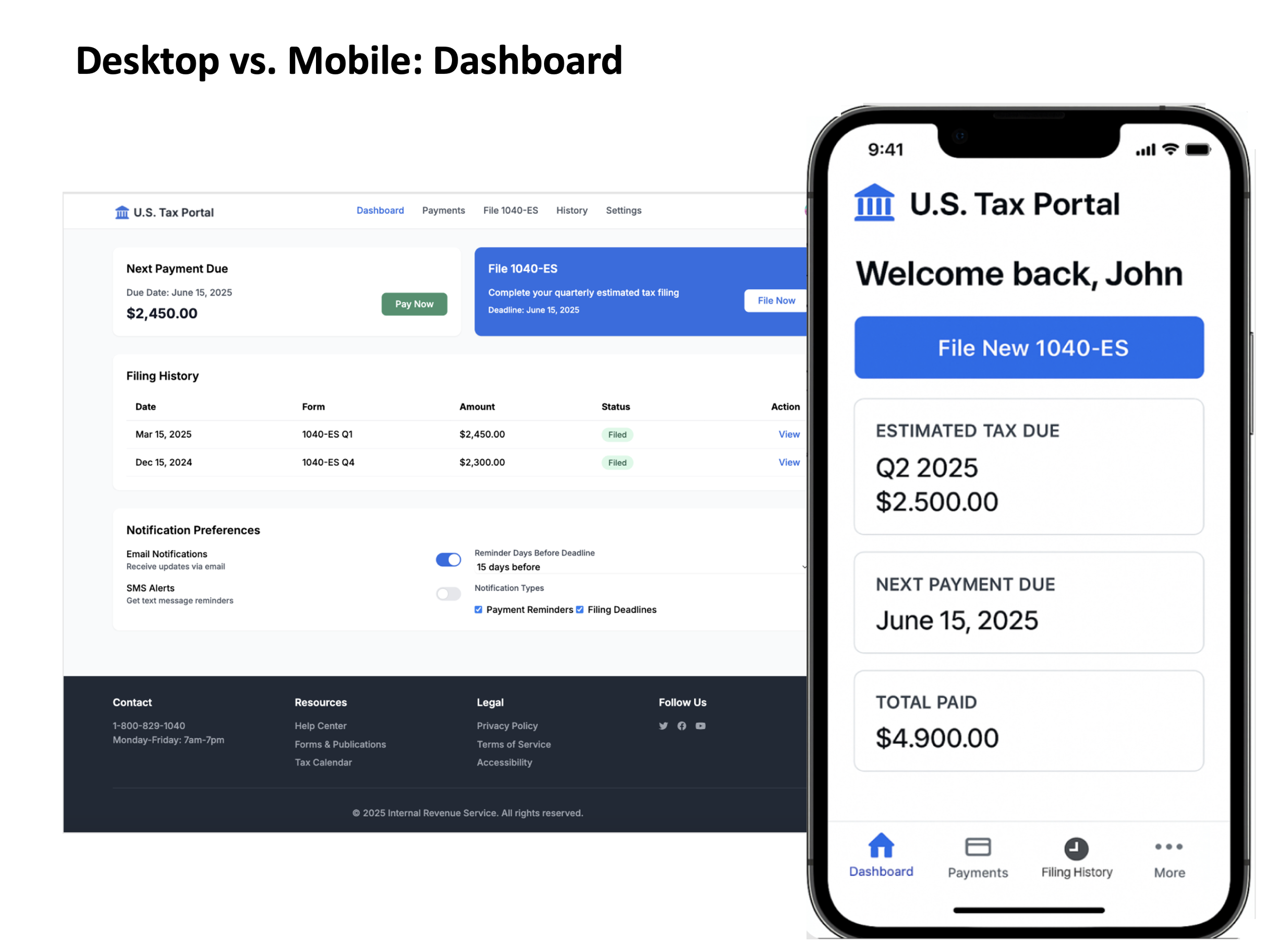

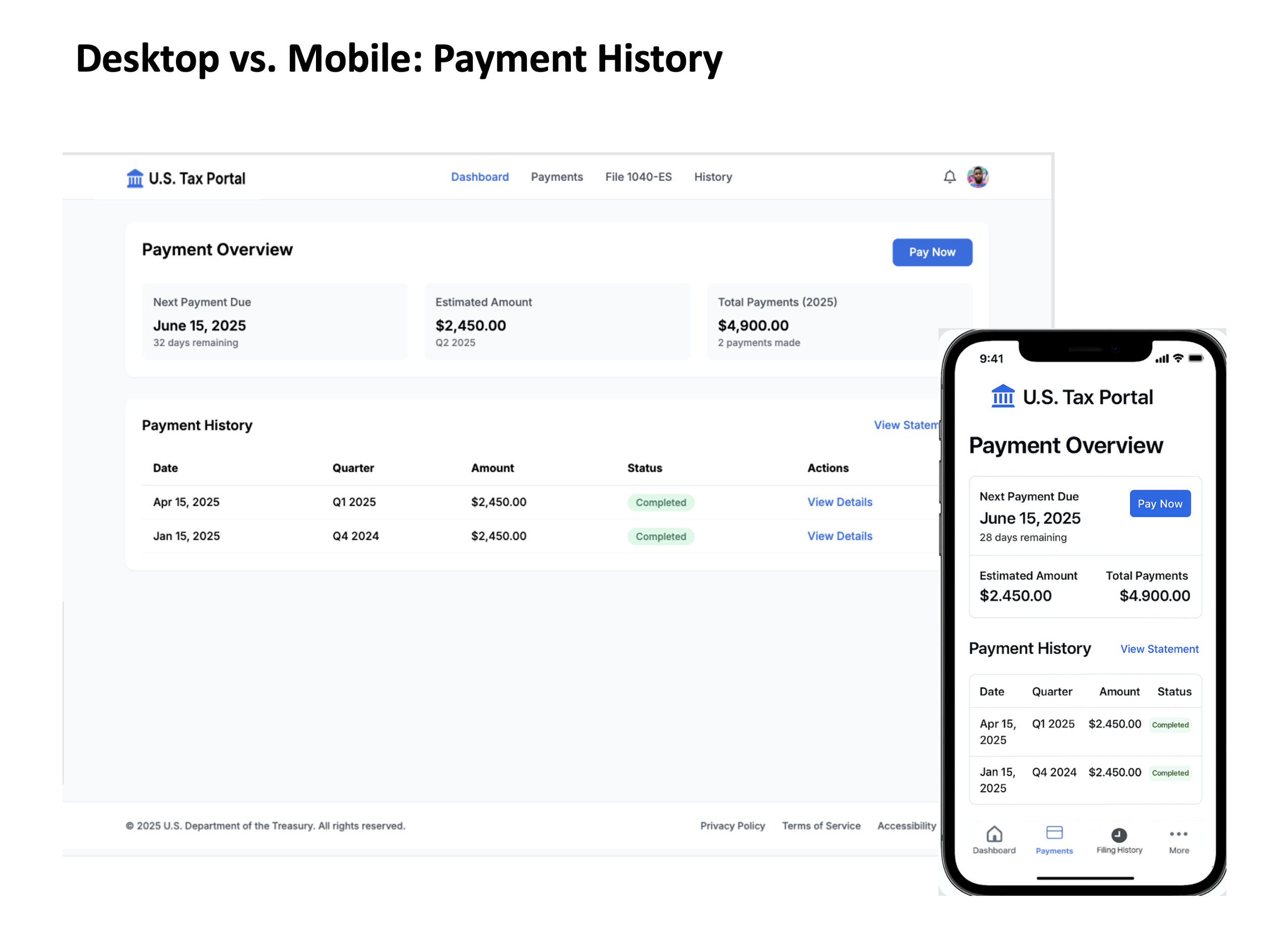

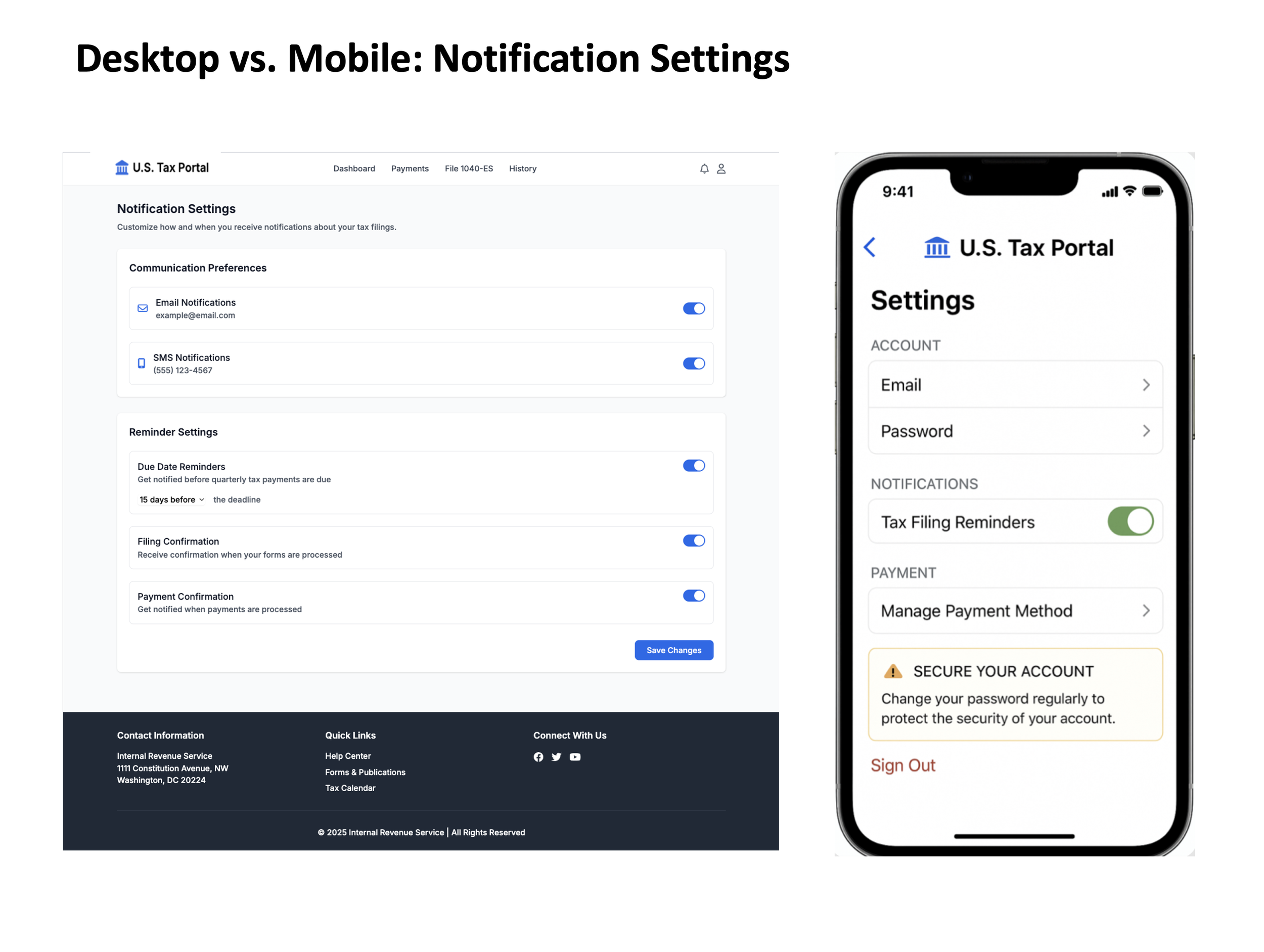

•This exercise translates a desktop-based tax filing experience into a native iOS app. It focuses on the Form 1040-ES quarterly estimated tax payments and simplifies a task-driven workflow for mobile users.

FAQs

The Problem

These platforms are desktop-first, overly complex, and lack mobile accessibility. This redesign aims to simplify the process, increase on-time payments, and provide a trustworthy mobile-first experience.

Outdated tax portals are difficult to use, especially on mobile. This leads to user frustration and delayed filings.

Why This Matters

User Perspective:

Prevents missed payments and penalties

Improves accessibility and ease of filing from mobile

Business Perspective:

Reduces support burden for mobile errors

Aligns with modern expectations for digital self-service experiences

Who I’m Solving For

•Freelancers, contractors, small business owners who need to make regular estimated tax payments without errors or missed deadlines.

•Business Impact: Encourages timely payments, lowers call center volume, and builds trust in digital infrastructure.

Design Decisions & Rationale

-

Content Logic

-

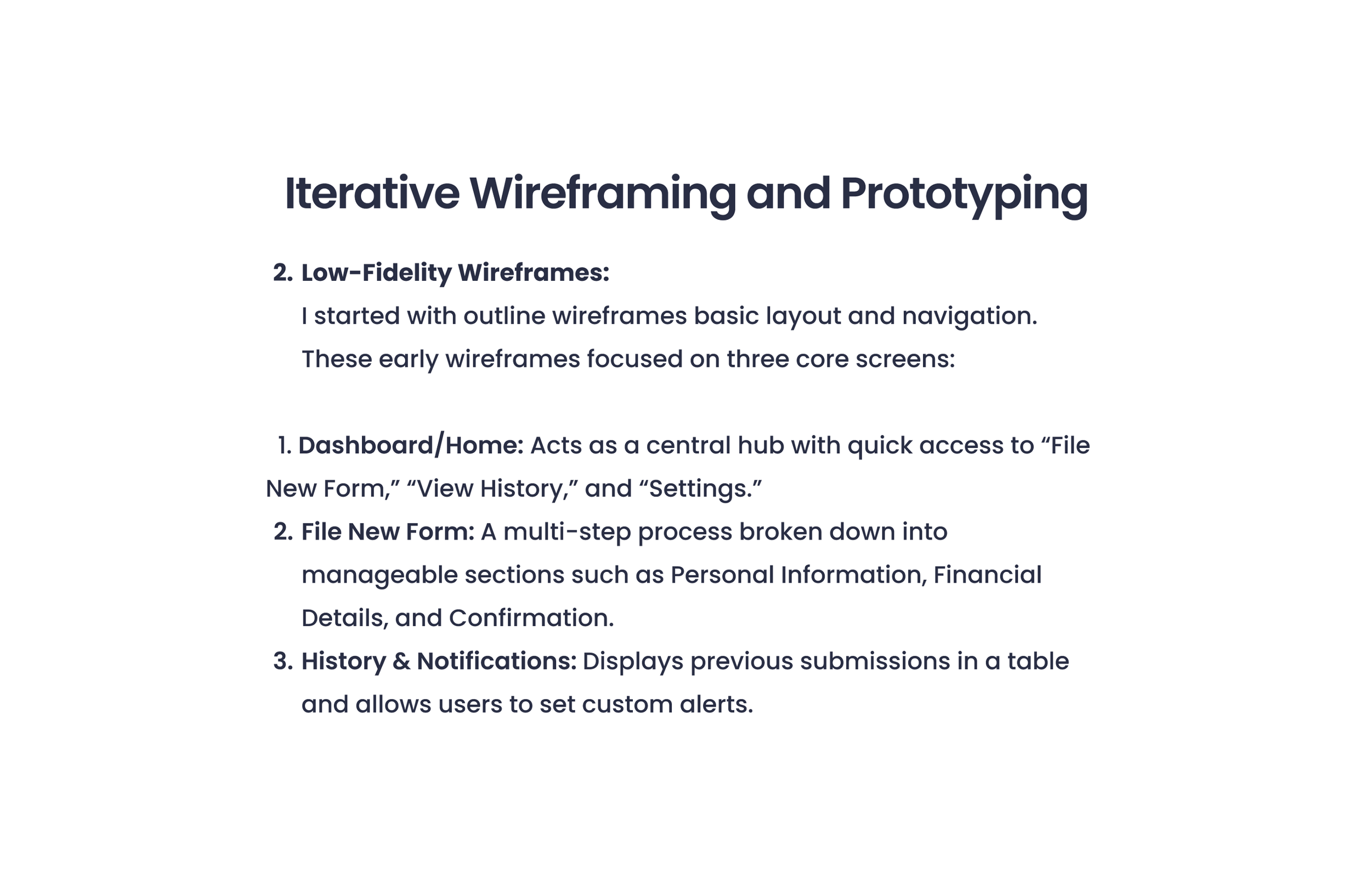

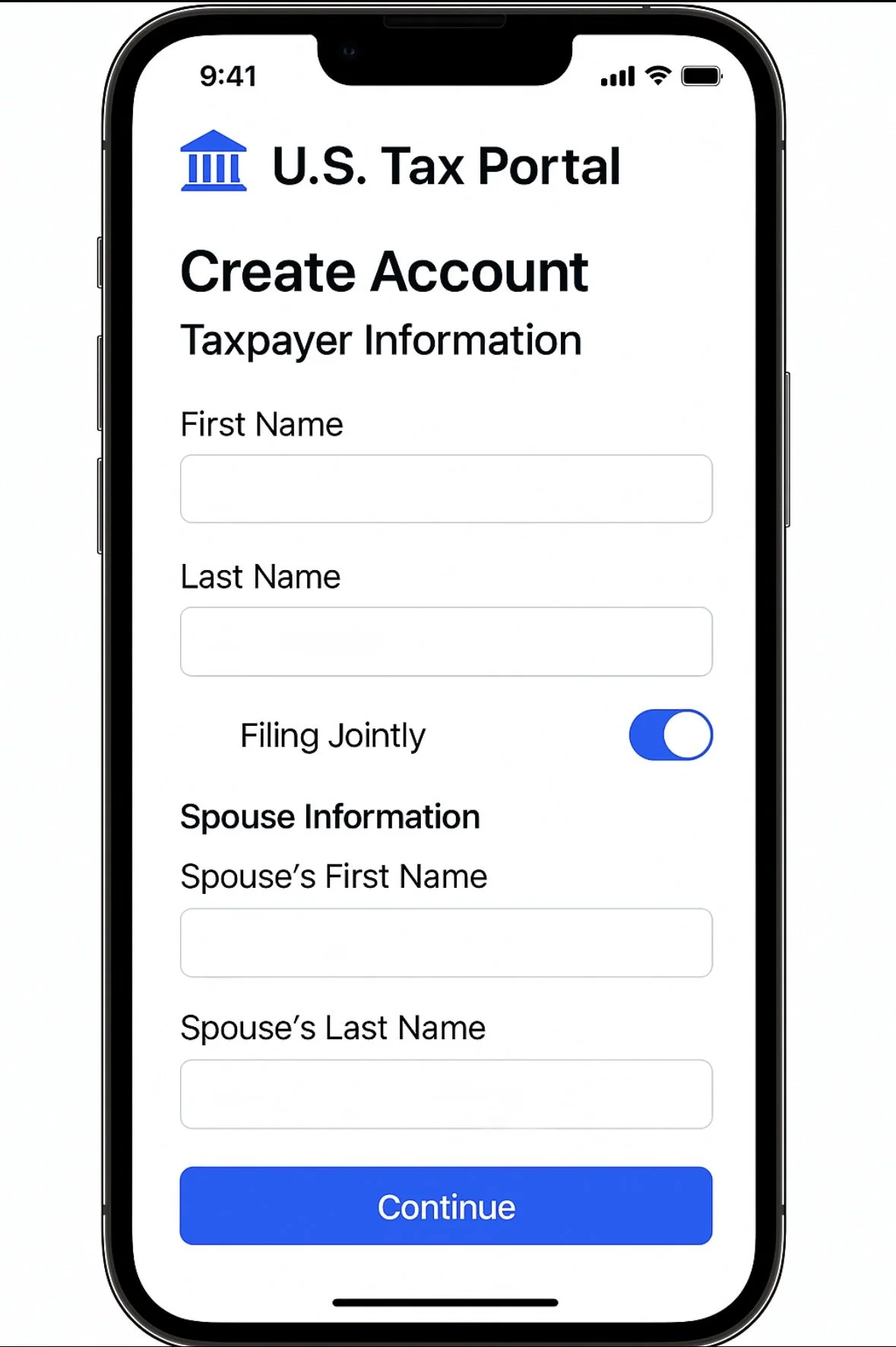

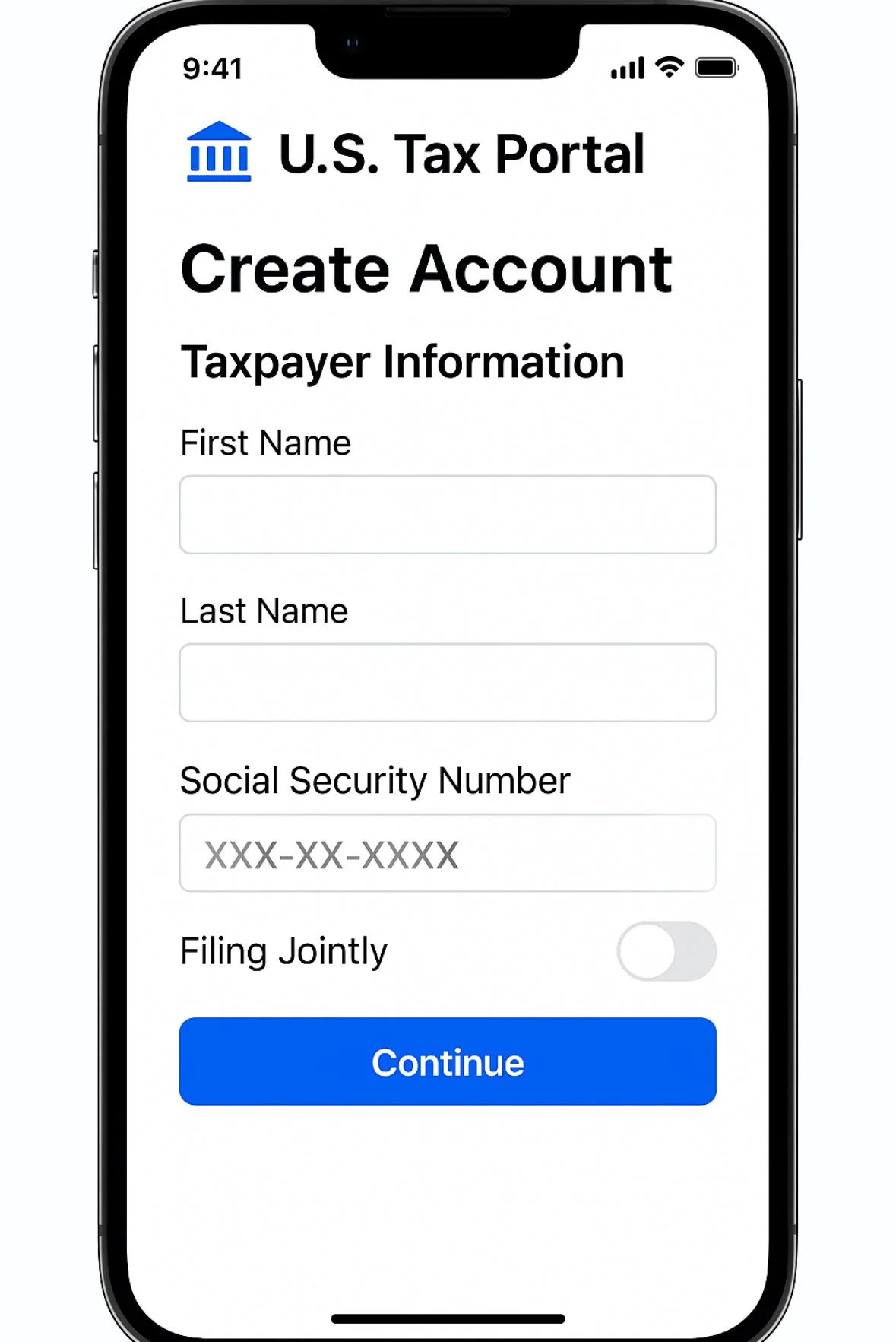

Screen Flow

-

Unnecessary Extras